Bitt-Developed CBDC to Aid in Disaster Relief

21 June 2021, Bridgetown, Barbados – DCash is set to

be the world’s first case-study of a central bank digital currency

(CBDC) used in rebuilding lives after a natural disaster. Developed by

global fintech company, Bitt, and issued by the Eastern Caribbean

Central Bank (ECCB), the CBDC will be issued in the volcano-struck

territory of Saint Vincent and The Grenadines (SVG) by early July 2021.

Since April 2021, citizens of the Eastern Caribbean territory have

been restoring infrastructure and livelihoods since a series of

eruptions from the decades-dormant La Soufrière volcano. Having

recognised the critical task of rebuilding that economy, Bitt and the

ECCB are working expeditiously to facilitate the rollout of DCash to

benefit the citizens and residents of SVG.

According to Bitt’s CEO, Brian Popelka, “Free cross-border

person-to-person DCash transactions and the ability to exchange between

cash and DCash will immediately transform the lives of those who have

been impacted by the volcanic eruptions. The efficacy of DCash in

rebuilding after a natural disaster will be another ‘world’s first’ for

Bitt’s Digital Currency Management System (DCMS)”.

Bitt’s DCMS allows the ECCB to securely mint and issue DCash to

participating financial institutions within the pilot countries. The

immediate objective of launching DCash in SVG is to provide faster,

safer and cheaper remote person-to-person financial transactions,

especially the exchange of DCash for physical cash. Authorised entities,

known as DCash Merchant Tellers, will facilitate these DCash and

physical cash exchanges. DCash users, in SVG or any of the other pilot

countries, will be able to send much-needed funds directly to

individuals in need or to relief organizations. Multidisciplinary teams

from Bitt are actively collaborating with ECCB officials to quickly

establish and promote the SVG DCash Merchant Teller network.

Bitt’s DCMS equips central banks, financial institutions, businesses,

organizations and consumers with the relevant digital currency

management components necessary to participate in fully digital

transactions for the post-COVID-19 economy.

Using the DCash Wallet App, users can make in-person or remote transactions to and from other DCash Wallet holders or merchants. The DCash Merchant App allows businesses to manage transactions between consumers and other businesses including vendor payments, e-commerce, and internal cash or DCash management.

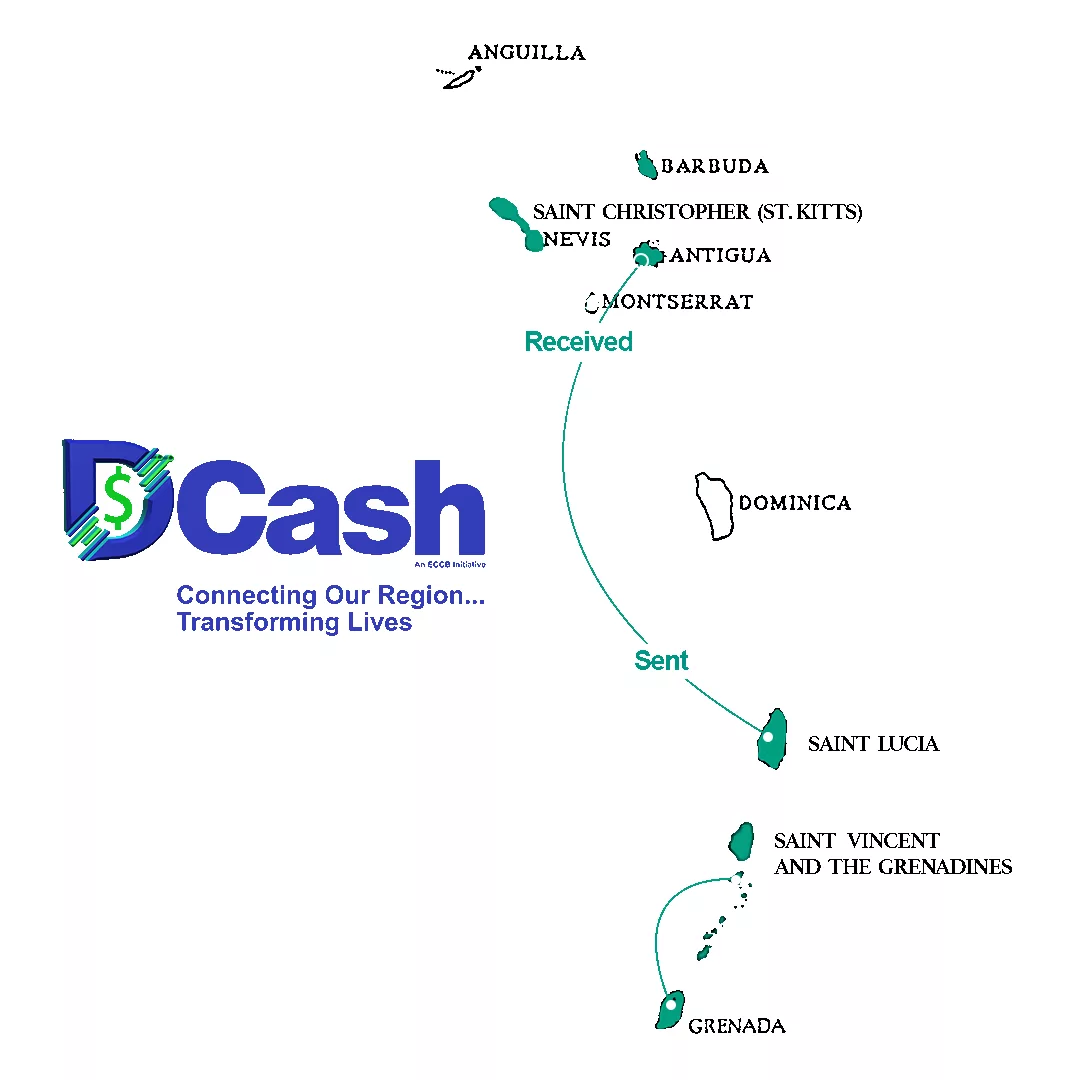

DCash has been in public circulation in four of the eight ECCB member countries – Antigua and Barbuda, Grenada, Saint Christopher (St Kitts) and Nevis and Saint Lucia, since 31 March 2021. The ECCB plans to issue DCash to all eight member countries by the end of September 2021.