Governments

To effectively integrate a central bank digital currency (CBDC) with traditional currency infrastructure, government entities and departments require a secure and robust technology solution.

The benefits of adopting digital currency functionality can be substantial. The ability to accept CBDC or stablecoin for government services and tax payments can increase revenues and help minimize missed payments and defaults. For outgoing payment transactions, government entities can pay employees, issue refunds and process other outgoing transactions effectively and affordably.

If you need to adopt CBDC technology, finding a practical and effective way to manage and process transactions is paramount. Bitt’s Digital Currency Management System (DCMS) and E-Government Suite provide a simple, secure and affordable solution.

To build an ecosystem for all stakeholders, you will need the below features:

- Governments

Digital Currency Manager

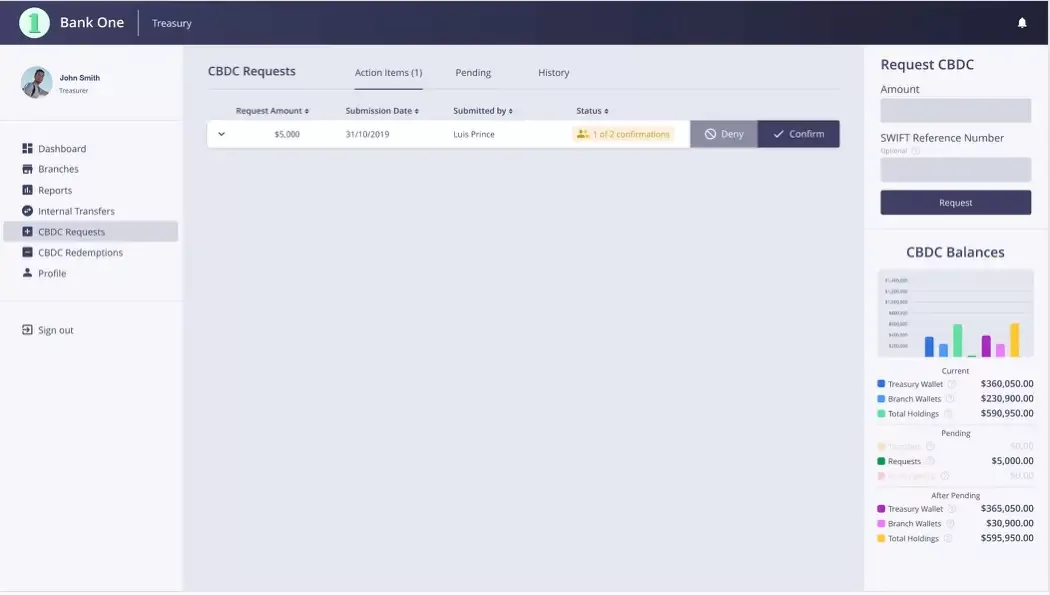

E-Government Digital Currency Manager (Back office)

POS App + E-Commerce Plugin (Front office)

Utilize digital currencies with back office operations including currency management, reporting, transactions, AML Compliance, and more.

Utilize digital currencies for incoming and outgoing payment streams, set custom governance settings for defined translation types, automate tax payments, and more.

Numa Core Architecture

Securely connect to the digital currency network(s) of your choice. Enable a variety of wallet types for your own institution and your clients. Set limits, manage user permissions and more.

Bitt Vault

Secure storage and transaction of digital currency and digital asset (private key management)

Customized governance structures, and customizable transaction types that require specific approval from defined stakeholders

Hardware security modules

Customized governance structures

E-Commerce Plugin

Accept payment for goods and services online

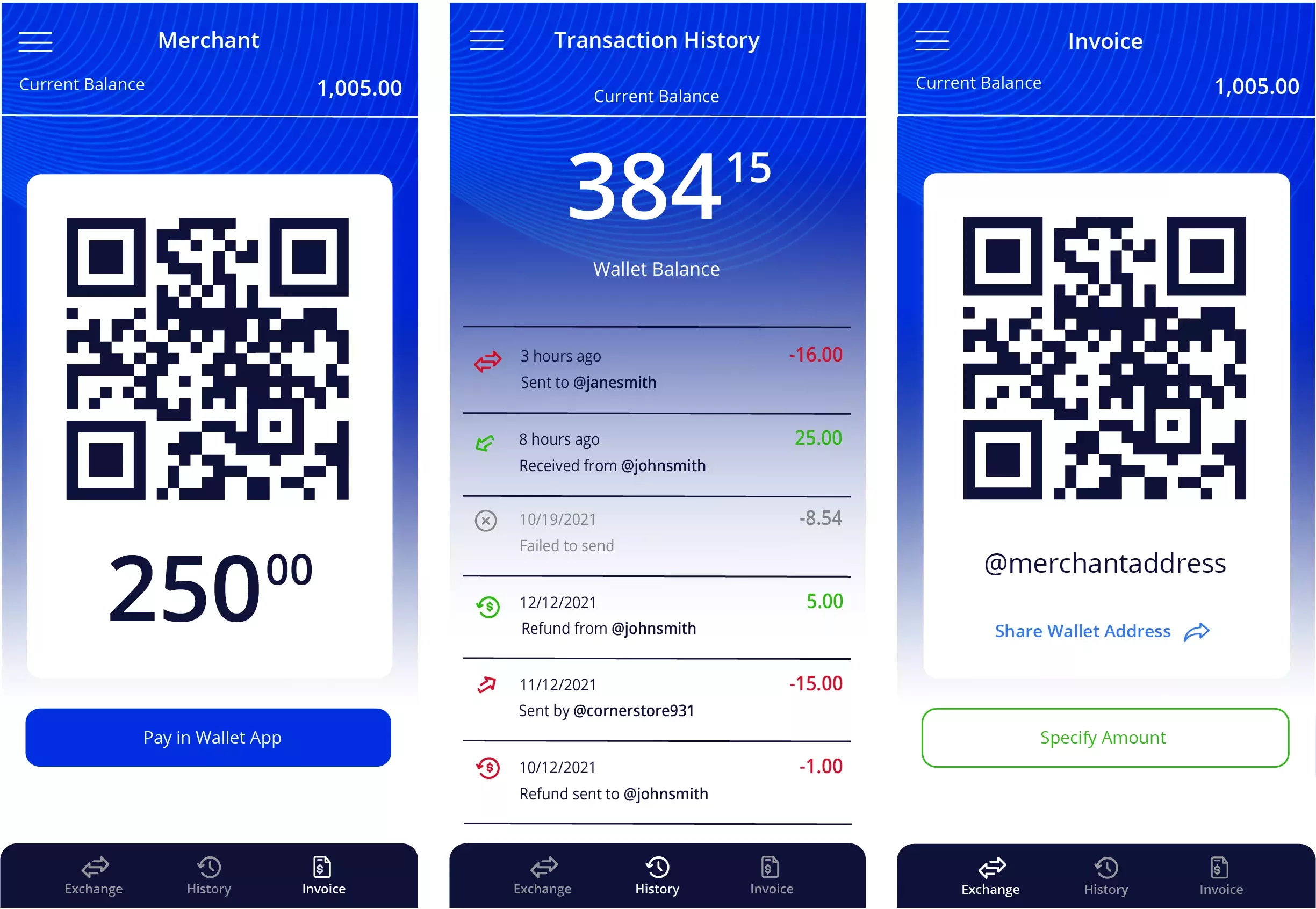

Merchant POS App

Accept payment for goods and services

Send payments

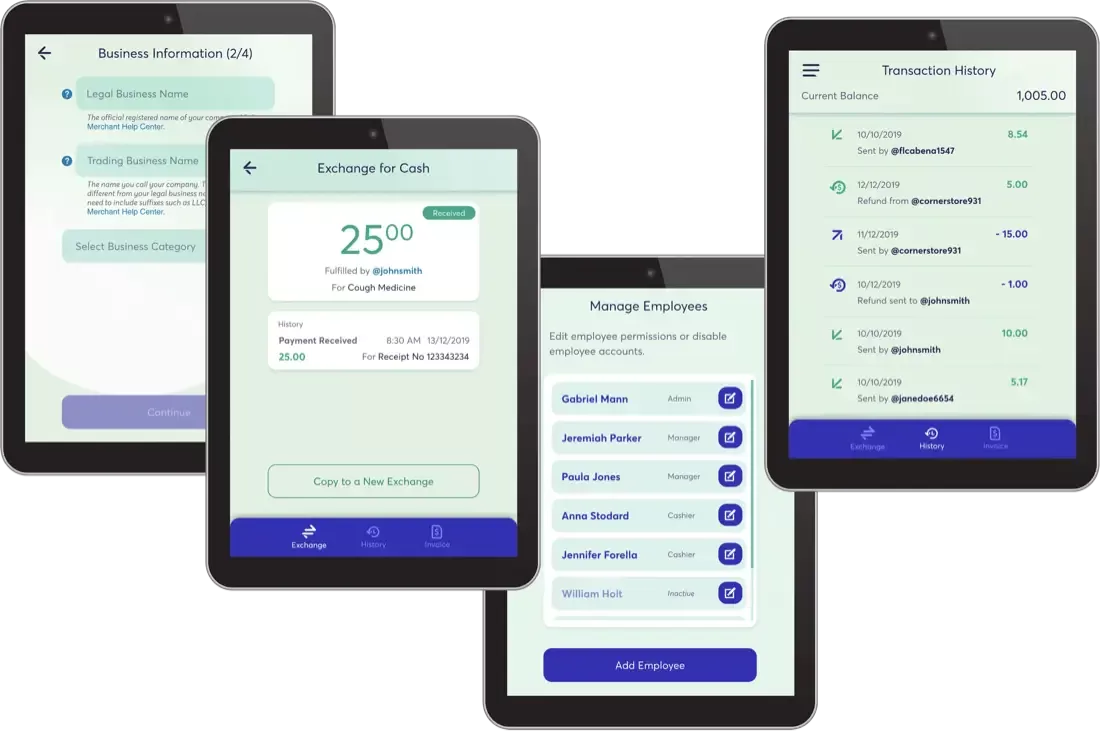

Sign up and register account

Static and dynamic QR codes

Multi-user login

User Management - custom permissions based on organization roles

Teller functions (cash-in, cash-out)

Refunds

Request payment (invoice generation and send via email)

Technical

The DCMS is engineered with modern software techniques to provide a secure, scalable, performant and highly available system. Security is designed-in, to use secure defaults, minimize attack surfaces and provide defense-in-depth. Independent modules allow each component to scale independently of others, allowing automatic adjustment to meet variable demands. Built-in redundancy, load balancing and health checks allow the system to automatically restore failed components, providing a highly available system. Careful attention to information management and storage protect consumer privacy, while allowing regulatory bodies access to needed transaction data.

Functional

Governments can begin accepting digital currencies for services, taxes, and other revenue streams — both online and in person — and can execute payments for payroll, benefits payments, tax refunds, and more, by using the Digital Currency E-Government Suite.

Features

-

E-Government Digital Currency Manager (Back office)

Bitt’s E-Government Suite add-on provides critical functionality for back-end operations. From the box, you can leverage transaction management and tracking features, reporting and transactional capabilities.

-

POS App + E-Commerce Plugin (Front office)

For user-facing functionality, our point-of-sale (POS) application and e-commerce plugin incorporate seamlessly into your existing transaction system. These tools allow you to automate payments, establish any desired governance rules and settings, and define digital currency transaction types.

You have the option of setting up system infrastructure to facilitate transactions both online and in-office.

Integrations

The DCMS can integrate with existing financial infrastructure, including RTGS and ACH networks, core banking systems as well as existing payment processing platforms including bill payment, airtime and top-up, remittance, and more.

Bitt Digital Currency E-Government Suite

Bitt’s E-Government Suite add-on provides critical functionality for back-end operations. From the box, you can leverage transaction management and tracking features, reporting and transactional capabilities.

For user-facing functionality, our point-of-sale (POS) application and e-commerce plugin incorporate seamlessly into your existing transaction system. These tools allow you to automate payments, establish any desired governance rules and settings, and define digital currency transaction types.

You have the option of setting up system infrastructure to facilitate transactions both online and in-office.

To learn more about the Bitt Digital Currency Management System tools for government entities, contact us today for a free demonstration.