Central Banks

Central banks around the world are now contemplating the imperative of rolling-out legal tender digital currencies.

From considering the feasibility of a central bank digital currency (CBDC) system launch to developing policies and governance standards, the challenges involved in this process are significant. As this remains largely uncharted territory, ready answers and solutions are not always apparent.

Bitt's Digital Currency Management System (DCMS) provides the solutions and answers you need. We have designed our technology solutions to function as a secure and robust infrastructure platform for every aspect of digital currency launch and operationalization.

To build an ecosystem for all stakeholders, you will need the below features:

- Central Banks/Monetary Authorities

- Financial Institutions

- Merchants

- Retail Consumers

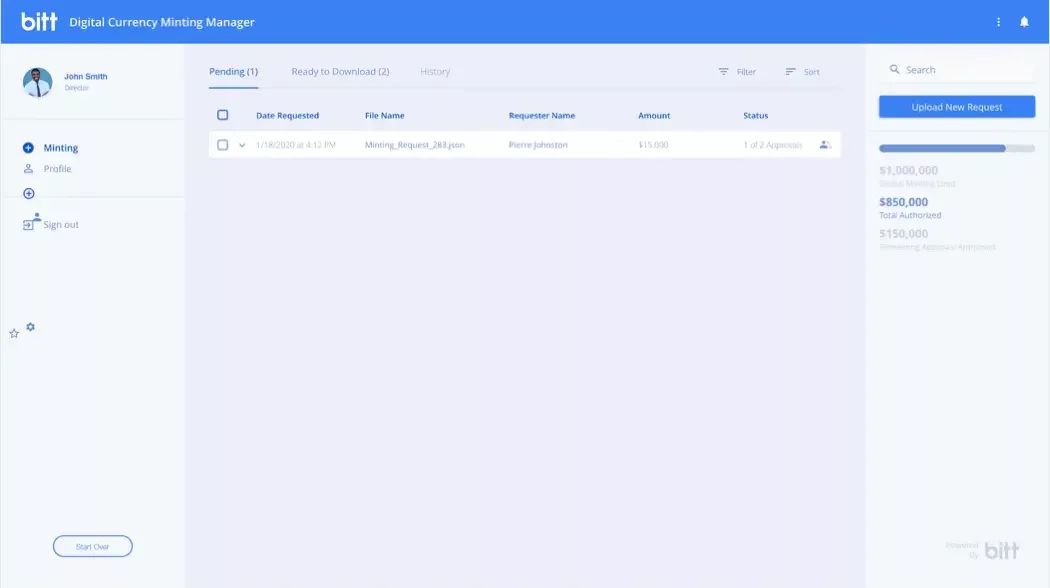

Digital Currency Minting Manager

Customizable governance frameworks for the secure minting of digital currency.

Segregated Hardware Security Module (HSM) with dedicated interface for executing minting transactions.

- Mint digital currency units

- Customized governance structures

- Air-gapped HSM Computer + HSM Keys for minting authorities

- Secure currency transfer to main network

- Reporting

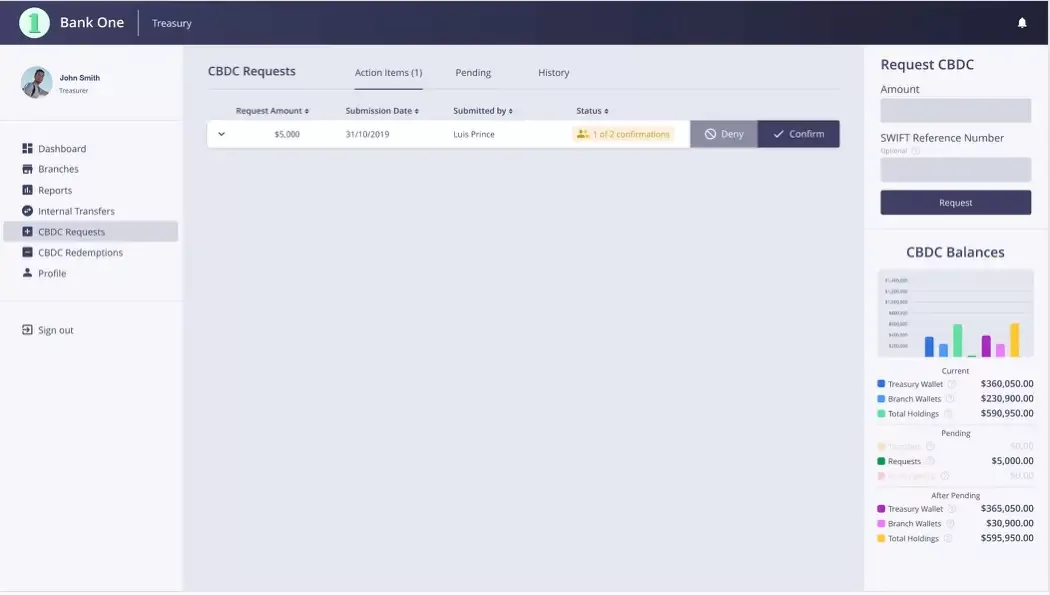

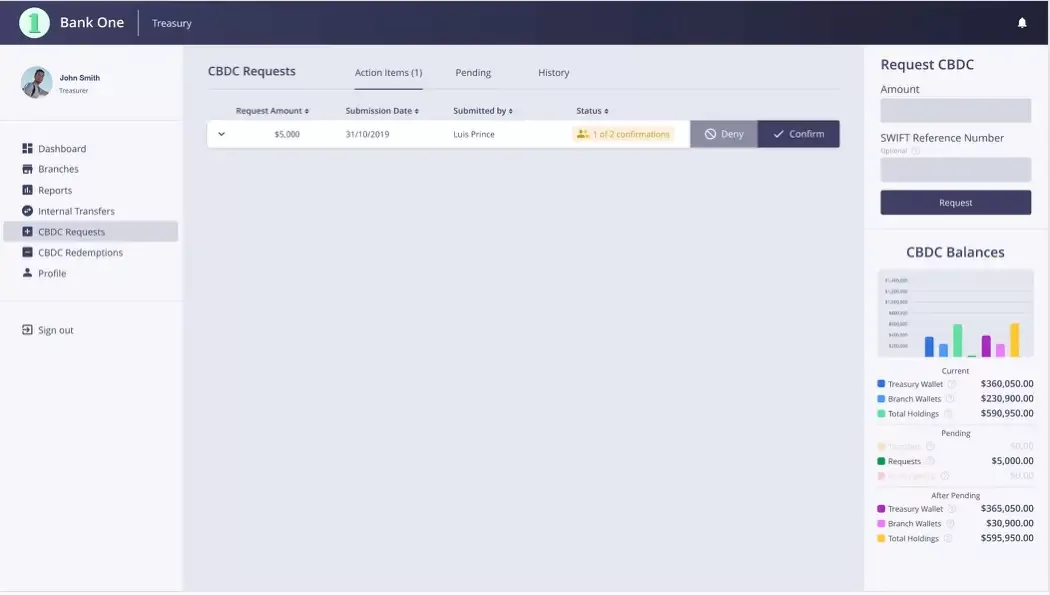

Digital Currency Manager

Securely issue, distribute, redeem, and destroy digital currency units in a fully auditable ecosystem.

Monitor transactional activity across defined periods using data settings including region, industry, and wallet type.

Numa Core Architecture

Define deployment parameters for the digital currency including interest rate, allowable integrations, wallet types and associated limits, role-based permission settings, and more. Integrate with a variety of applications and other digital currency networks.

- High performance CBDC-standard transaction network; option for distributed nodes as delegated by central bank (dependent on transaction network chosen)

- Cloud deployed/containerized modules using Kubernetes

- Permissioned API structures for marketplace integrations

- Integration into third-party custodians

- Extensive business logic (eg. transaction limits, wallet types/metadata, monitoring and reporting, security configurations, interest rates, integrations with other financial networks like foreign exchange, smart contract functionality)

Bitt Vault

Secure storage and transaction of digital currency and digital asset (private key management)

Customized governance structures, and customizable transaction types that require specific approval from defined stakeholders

Hardware security modules

Customized governance structures

Digital Currency Operations Manager

- Currency and payments management e.g., between FI and CB, between FI and FI, and between FI and merchant/retail clients

- Wallet creation for a variety of client types

- E-Commerce management

- Fee structure configuration

DC AML Compliance Manager

AML compliance e.g., KYC and KYB verification, sanctions screening, transactions reporting and monitoring, client investigation, client profile management, etc.

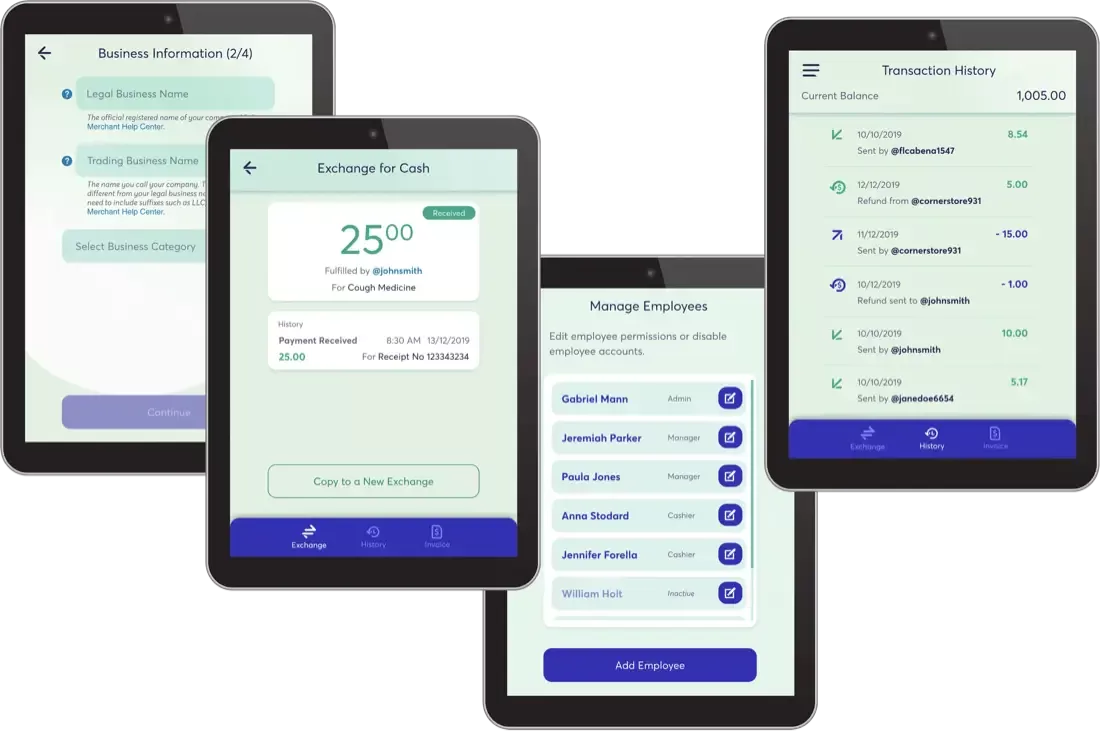

Merchant POS App

Accept payment for goods and services

Send payments

Sign up and register account

Static and dynamic QR codes

Multi-user login

User management - custom permissions based on organization roles

Teller functions (cash-in, cash-out)

Refunds

Request payment (invoice generation and send via email)

E-Commerce Plugin

Accept payment for goods and services online

Enterprise Digital Currency Manager

Currency and payments management e.g., between FI and merchant, between merchant and merchant, and between merchant and consumer

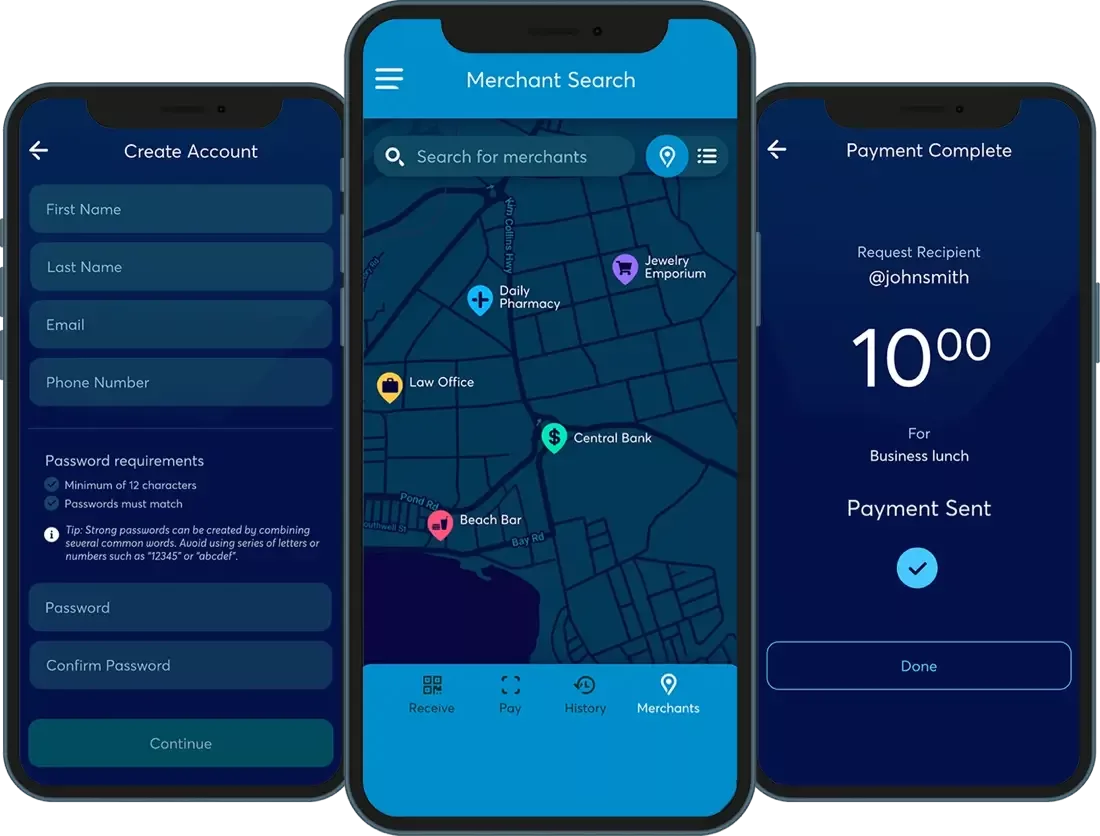

Digital Currency Mobile Wallet

Sign up and register account

Send and receive payments

Contact list integration

Maps integration

Top-up, bill payment

Payee look up

Prepayment authorization

App notifications

Technical

The DCMS is engineered with modern software techniques to provide a secure, scalable, performant and highly available system. Security is designed-in to use secure defaults, minimize attack surfaces and provide defense-in-depth. Independent modules allow each component to scale independently of others, allowing automatic adjustment to meet variable demands. Built-in redundancy, load balancing and health checks allow the system to automatically restore failed components, providing a highly available system. Careful attention to information management and storage protects consumer privacy while allowing regulatory bodies access to needed transaction data.

Functional

Central banks can deploy a CBDC to target market(s) via SDK, API, or through applications for target stakeholders. Bitt equips central banks with all the tools it requires to securely mint, store, issue, distribute, redeem, and destroy CBDC.

Bitt can also provide applications that enable CBDC transactions for government, financial institutions, merchants, and consumers in a CBDC pilot scenario and beyond.

Features

-

Digital Currency Minting Manager

Customizable governance frameworks for the secure minting of digital currency. Segregated Hardware Security Module (HSM) with dedicated interface for executing minting transactions.

- Mint digital currency units

- Customized governance structures

- Air-gapped HSM Computer + HSM Keys for minting authorities

- Secure currency transfer to main network

- Reporting

-

Digital Currency Manager

Securely issue, distribute, redeem, and destroy digital currency units in a fully auditable ecosystem.

Monitor transactional activity across defined periods using data settings including region, industry, and wallet type.

-

Numa Core Architect

Define deployment parameters for the digital currency including interest rate, allowable integrations, wallet types and associated limits, role-based permission settings, and more. Integrate with a variety of applications and other digital currency networks.

- High performance CBDC-standard transaction network; option for distributed nodes as delegated by central banks (dependent on transaction network chosen)

- Cloud deployed / containerized modules using Kubernetes

- Permissioned API structures for marketplace integrations

- Integration into third party custodians

- Extensive business logic (eg. transaction limits, wallet types/metadata, monitoring and reporting, security configurations, interest rates, integrations with other financial networks eg. foreign exchange, smart contract functionality)

-

Bitt Vault

- Secure storage and transaction of digital currency and digital asset (private key management)

- Customized governance structures and customizable transaction types that require specific approval from defined stakeholders

- Hardware security modules

Integrations

The DCMS can integrate with existing financial infrastructure, including RTGS and ACH networks, core banking systems, as well as existing payment processing platforms including bill payment, airtime and top-up, remittance, and more.

Just like traditional currency ecosystems, CBDC systems require multiple elements to function correctly. At the core of the system’s infrastructure is the need for a ledger, governing rules and processing functions. Systems require appropriate safeguards and redundancies to ensure that it is resilient in the face of security risks and technical failure.

To ensure equitable financial inclusion, systems must be simple to access and operate. CBDC systems must also inspire trust and provide users with a sense of privacy and security. Features must be highly efficient and sufficiently robust to offer a wide range of financial services.

Finally, processing functions must effectively interface with those of merchants, end-users and other participants. This interoperability must ensure the prompt and reliable flow of funds throughout the domestic and international payment ecosystems.

Compatibilities

- The Bitt DCMS meets the ITU and Stanford University CBDC standards.

- DCMS can integrate with payment networks who support the ISO 20022 messaging standards.

- DCMS can integrate with both blockchain-based and traditional transaction networks.

Your CBDC Design, Development and Management Partner

With demonstrated experience and success in launching CBDC and stablecoin systems, Bitt has the scalable and customizable technology solutions you need for today and in the future.

Our DCMS and Monetary Authority (MA) Suite includes a digital currency minting manager with a dedicated interface for minting central bank digital currencies and functions for the secure issue, distribution, redemption and destruction of CBDC. You will also have access to your own private, key-managed Bitt Vault with customized governance structure and customizable transaction types.

We have designed our technology solutions to make CBDC deployment as safe, easy and affordable as possible. As a part of our overall central bank digital currency solutions, we can assist you through every phase of development, testing, rollout and beyond.

Contact us today to request your demonstration of Bitt’s DCMS and MA suite for central banks.