Financial Institutions

Around the world, central banks and national monetary authorities are considering, testing or even launching central bank digital currencies (CBDCs). In this context, digital currency is legal tender, existing alongside — and as an alternative to — traditional fiat currency instruments.

As this trend continues, licensed financial institutions are faced with the inevitable yet daunting prospect of CBDC integration.

Bitt’s Digital Currency Management System (DCMS) is a robust technology solution that offers a full range of features out of the box. When paired with our Financial Institution (FI) Suite, our DCMS for financial institutions provides everything you need to integrate digital currencies and stablecoins seamlessly with your legacy systems.

To build an ecosystem for all stakeholders, you will need the below features:

- Central Banks/Monetary Authorities

- Financial Institutions

- Merchants

- Retail Consumers

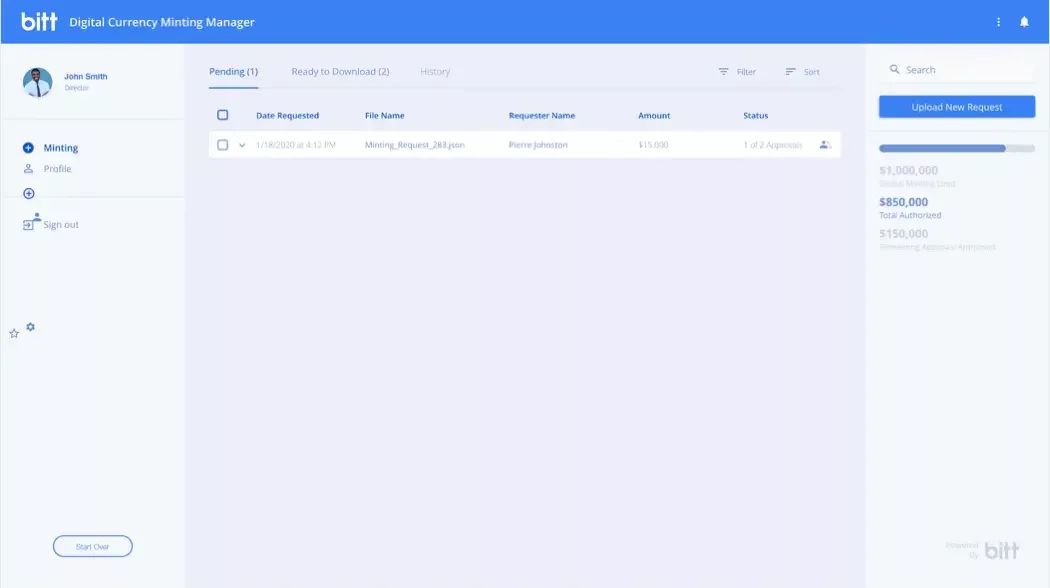

Digital Currency Minting Manager

(This is required if you are creating a stablecoin)

Customizable governance frameworks for the secure minting of digital currency.

Segregated Hardware Security Module (HSM) with dedicated interface for executing minting transactions.

Mint digital currency units

Customized governance structures

Air-gapped HSM Computer + HSM Keys for minting authorities

Secure currency transfer to main network

Reporting

Digital Currency Manager

(This is required if you are creating a stablecoin)

Securely issue, distribute, redeem, and destroy digital currency units in a fully auditable ecosystem.

Monitor transactional activity across defined periods using data settings including region, industry, and wallet type.

NUMA Core Architecture

(This is required if you are creating a stablecoin)

Define deployment parameters for the digital currency including interest rate, allowable integrations, wallet types and associated limits, role-based permission settings, and more. Integrate with a variety of applications and other digital currency networks.

Bitt Vault

(This is required if you are creating a stablecoin)

Secure storage and transaction of digital currency and digital asset (private key management)

Customized governance structures, and customizable transaction types that require specific approval from defined stakeholders

Hardware security modules

Customized governance structures

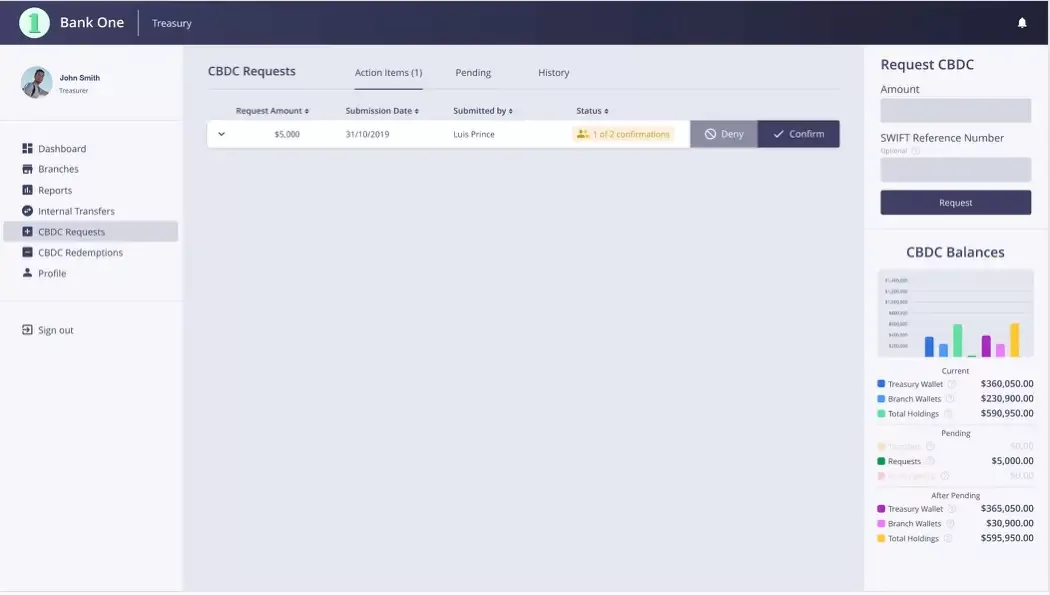

Digital Currency Operations Manager

(This is required if you are integrating with a CBDC or stablecoin)

Bitt’s Digital Currency Operations Manager facilitates transactions between central banks and financial institutions, between financial institutions, and between financial institutions and their customers (both merchant and retail).

Currency and payments management eg. between LFI and CB, between LFI and LFI, and between LFI and merchant/retail clients

Wallet creation for a variety of client types

E-commerce management

Fee structure configuration

DC AML Compliance

(This is required if you are integrating with a CBDC or stablecoin)

AML compliance eg. KYC and KYB verification, sanctions screening, transactions reporting and monitoring, client investigation, client profile management, etc.

Numa Core Architecture

(This is required if you are integrating with a CBDC or stablecoin)

Using NUMA core architecture, our network platform provides a highly secure level of connectivity that allows institutions to enable various wallet types, manage user permissions and establish limits.

Bitt Vault

(This is required if you are integrating with a CBDC or stablecoin)

Our Bitt Vault utilizes private key management, providing secure storage for digital assets.

Secure storage and transaction of digital currency and digital asset (private key management)

Customized governance structures, and customizable transaction types that require specific approval from defined stakeholders

Hardware security modules

Customized governance structures

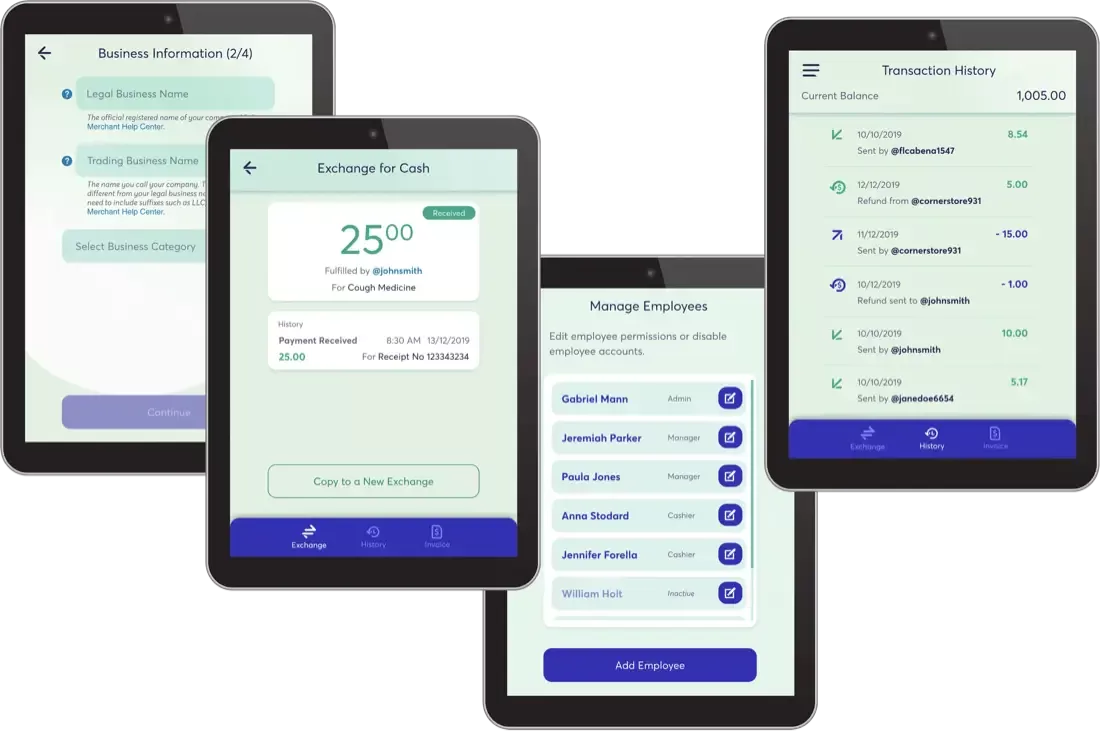

Merchant POS App

Our Point-of-Sale (POS) app allows merchant customers to send and accept payments and facilitates a variety front- and rear-facing transaction management tasks.

Accept payment for goods and services

Send payments

Sign up and register account

Generate static and dynamic QR codes

Multi-user login

User management: custom permissions based on organization roles

Teller functions (cash-in, cash-out)

Refunds

Request payment (invoice generation and send via email)

Enterprise Digital Currency Manager

Currency and payments management eg. between FI and merchant, between merchant and merchant, and between merchant and consumer

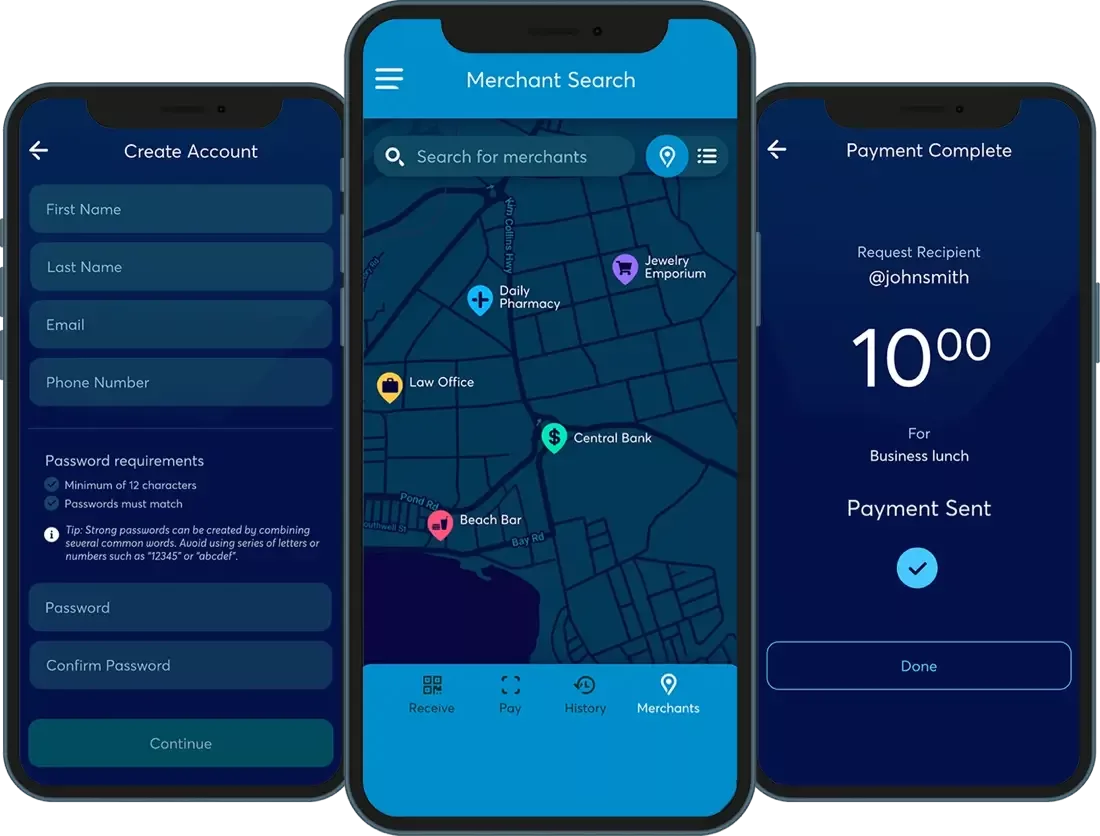

Digital Currency Mobile Wallet

Our Digital Currency Mobile Wallet provides full functionality for retail consumers, including the ability to send and receive digital currency payments.

Sign up and register account

Send and receive payments

Contact list integration

Maps integration

Top-up, bill payment

Payee lookup

Prepayment authorization

App notifications

Technical

The DCMS is engineered with modern software techniques to provide a secure, scalable, performant and highly available system. Security is designed-in to use secure defaults, minimize attack surfaces and provide defense-in-depth. Independent modules allow each component to scale independently of others, allowing automatic adjustment to meet variable demands. Built-in redundancy, load balancing and health checks allow the system to automatically restore failed components, providing a highly available system. Careful attention to information management and storage protect consumer privacy, while allowing regulatory bodies access to needed transaction data.

Functional

Financial institutions (FIs) can deploy a stablecoin to target market(s) using Bitt DCMS applications, or via Bitt Numa SDKs and APIs. Bitt equips FIs with all the tools it requires to securely mint, store, issue, distribute, redeem, and destroy a stablecoin.

Bitt can also provide applications that enable stablecoin transactions for government, merchants, and consumers in a stablecoin pilot scenario and beyond.

Features

-

Digital Currency Operations Manager

Bitt’s Digital Currency Operations Manager facilitates transactions between central banks and financial institutions, between financial institutions, and between financial institutions and their customers – both merchant and retail.

- Currency and payments management eg. between FI and CB, between FI and FI, and between FI and merchant/retail clients

- Wallet creation for a variety of client types

- E-commerce management

- Fee structure configuration

-

Bitt Vault

Secure storage and transaction of digital currency and digital asset (private key management)

Customized governance structures and customizable transaction types that require specific approval from defined stakeholders

Hardware security modules

Customized governance structure

-

AML Compliance Module

AML compliance eg. KYC and KYB verification, sanctions screening, transactions reporting and monitoring, client investigation, client profile management, etc.

Integrations

The DCMS can integrate with existing financial infrastructure, including RTGS and ACH networks, core banking systems as well as existing payment processing platforms including bill payment, airtime and top-up, remittance, and more.

DCMS Products Made for Financial Institutions

Is your financial institution ready to make the transition to digital currency or stablecoins? If so, Bitt has the products and solutions that make the process simple and secure. Our products are secure, highly scalable and affordable.

You will have access to our team of digital currency experts to support you through every phase of integration. We provide CBDC Workshops to help you through the planning and policy development phases. We can also provide you with our CBDC Sandbox, allowing your stakeholders to interact in a live, simulated environment.

Contact us now to request your complimentary demonstration of our Digital Currency Management System for financial institutions.