International Fintech Company, Bitt, Writes CBDC History

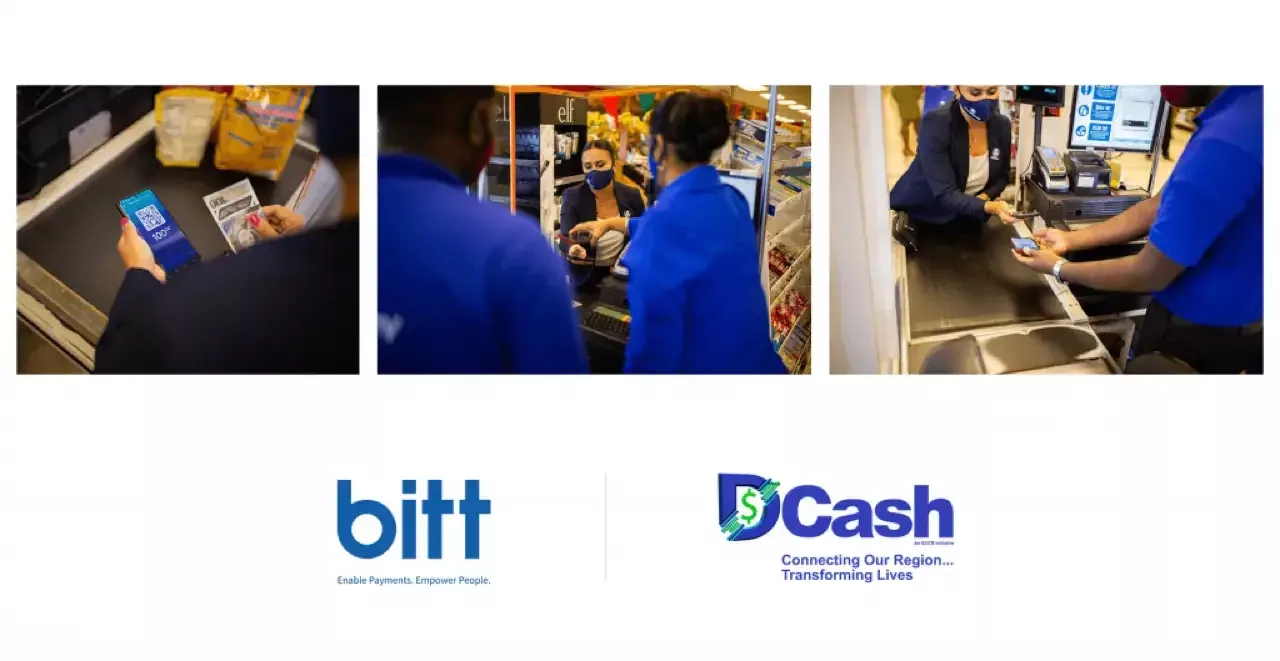

On Friday, 12 February 2021, international fintech company, Bitt, in partnership with the Eastern Caribbean Central Bank (ECCB), executed the first successful retail central bank digital currency (CBDC) consumer-to-merchant transaction using DCash, the ECCB digital currency. The transaction was completed at Geo F. Huggins’ Foodland, in the island of Grenada, as part of the digital cash infrastructure project .

Commenting on this achievement, Governor of the ECCB, Timothy N. J.

Antoine said, “This transaction is a major milestone in our mission to

place DCash in the hands of the people of the Eastern Caribbean Currency

Union (ECCU). I congratulate Geo F. Huggins on making history. We are

now on the cusp of the public launch of DCash.”

The ECCB has begun to issue DCash to participating financial

institutions to enable customer purchases at selected merchants, as part

of the closed segment of the DCash pilot. This live exercise is the

final step before the public launch in four of the ECCU’s eight

sovereign member countries.

Over the last year, Bitt has worked hand in hand with the ECCB in

creating the DCash infrastructure using Bitt digital currency management

system (DCMS). Bitt has further enabled every stakeholder of the

ecosystem, including financial institutions, merchants, government

agencies, and end-users, with the infrastructure and applications

necessary to fully issue, transfer, hold, transact and remediate using

digital currency DCash.

CEO of Bitt, Brian Popelka, stated, “We are extremely proud to

provide the ECCB with our digital currency management solution to

efficiently service the entire financial ecosystem within the ECCU.

Bitt’s DCMS is at the forefront of integrating digital currency

operations into any financial infrastructure. The future of financial

transactions is about delivering ultimate efficiency, end-to-end, for

institutions, businesses and customers.”

Bitt’s mandate is to promote financial inclusion through our

technology of digital cash. The DCash Pilot is a key initiative of the

ECCB’s transformational agenda as articulated in its 2017-2021 Strategic

Plan. Governor Antoine spoke about this historic pilot in that context

saying, “DCash is about the people of the ECCU. Through DCash, we intend

to increase their financial inclusion, competitiveness and resilience.”

Over the next few weeks, Bitt is supporting the ECCB as registered financial institutions, merchants and agents achieve full readiness for the public roll out in the countries of Antigua and Barbuda, Grenada, Saint Kitts and Nevis and Saint Lucia.

About Bitt

Bitt is a global financial technology company that provides

digital currency solutions to financial institutions, central banks and

ecosystem participants worldwide. Bitt is at the forefront of financial

innovation, with a specialization in central bank digital currencies

(CBDC). The company’s Digital Currency Management System (DCMS)

leverages blockchain-based distributed ledger technology to introduce

the benefits of the most efficient financial ecosystem to date.

To learn more about Bitt, contact Simon Chantry, Co-Founder and CIO at: +1-778-938-1156 or [email protected]

To learn more about Digital Currency and CBDC, visit: https://www.bitt.com/cbdc-hub