Why has Bitt created Barbados digital dollars on The Blockchain?

Before we dive into the massive potential of digital assets and cryptocurrency on financial services sector and the world, let’s take a stroll down memory lane, where the birth of ‘Cash’ started. Paper bills were first used by the Chinese, they began by carrying folding money during the Tang Dynasty (A.D. 618-907) – mostly privately issued bills of credit or exchange. This lasted more than 500 years until the practice caught on in Europe around the 17th century. The word cash was originally used to depict round bronze coins with square holes usually referred to as kai-yuans.

Cash has been around much longer than any of us consider. It is engrained in our day to day life, but it has some shortcomings. Something we as a society rarely consider is the cost a government undertakes and the continued resources it costs our planet to produce the paper money we so casually use in our day to day lives; all for naught since these bills ultimately wear out. The smaller the denomination, the more often we use it, the shorter the lifespan. The $5 bill lasts on average a meager 2 years, while a $100 bill can last more than seven years. Over that time, owing to inflation, its value will decline — which is the perfect excuse to spend it quickly.

Most of our parents taught us to ‘save something’ for a rainy day. Back then they hid valuable things in a mattress or a shoe box. The banks understood the need for physical protection of our valuables and gradually became good at it. Guarding our hard earned salary was not a cross we wanted to carry and saving up stores of it seemed like a pretty good idea at the time

Unfortunately that idea of ‘saving money’ was tarnished with the introduction of inflation, which is defined as a continuous increase in the overall level of prices for goods and services. It is calculated as an annual percentage increase. As inflation rises, every dollar buys a smaller percentage of that respective good or service.

The value of a dollar does not stay steady when there is inflation. The value is realized in terms of buying power, which is the real value of goods that the money can acquire. When inflation increases, there is a correlative decline in direct purchasing power. For example, if the inflation rate is 3% annually, in theory a $1 pack of gum should cost $1.03 in a year. After inflation, your dollar can’t buy the same goods it previously could.

With the advent of cash, people soon realised that storing it in large amounts generally leads to the detriment of the person carrying holding it. There were little ways that one could mitigate this risk, which is one of the reasons the Bank became the only viable option for the everyday citizen.

Bitt has revolutionized the financial landscape by creating the Barbados Digital Dollar. All the while working alongside the central bank of Barbados to ensure that all aspects of this technological advancement are universally understood and appreciated. Barbados is one of the few places in the world which has embraced this concept and understands this technology’s fundamental role in the future of financial services.

Bitt has created an easy-to-use, frictionless store of value which does not rely on the continued reproduction of paper, and which no longer requires the policing of counterfeit bills which continually plague local vendors. We have advanced technologically and we now have digital ways to guarantee that the value being sent is legitimate.

The Blockchain supports a scripting language that can be used to store metadata. Colored Coins is a concept that allows attaching metadata to Bitcoin transactions while leveraging the infrastructure for issuing and trading immutable digital assets that represent real world value.

- What does this mean for our local economy?

- What does this mean for our environment?

- What does this mean for peer to peer transactions?

- What does this mean for the financial services sector?

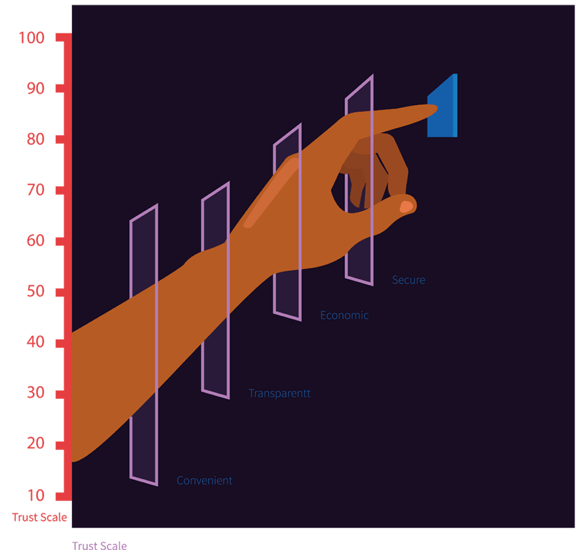

There are so many sectors we have yet to consider which will be positively impacted by the use of this technology, let’s hand pick a few positive attributes which we may associate with this new technology:

- Transparency / Honesty

- Accountability

- Immutability

- Incorruptible

- Consistency

- Durability

- Verifiable

- Unassailable

In a real world example; We have a small, family owned shop which does not meet the minimum requirements for the installation of a PoS terminal for credit/debit cards. With a simple cell phone and minimal setup, Bitt has empowered this business owner. Now this small family business has access to instant and secure digital payments with no hoops or hassle.

As most of us in the space know, each one of these bullet points could be its own independent article. We here in Barbados are overjoyed that our forward thinking government understands the deep ramifications this technology will have on the world, they don’t want to sit by idly and observe as others use it for the betterment of their respective society.

They want to be proactive in laying some foundations, which will empower future generations to come, and Bitt is going to help them get there.