Succcess Stories

eNaira

Building the first CBDC in Africa

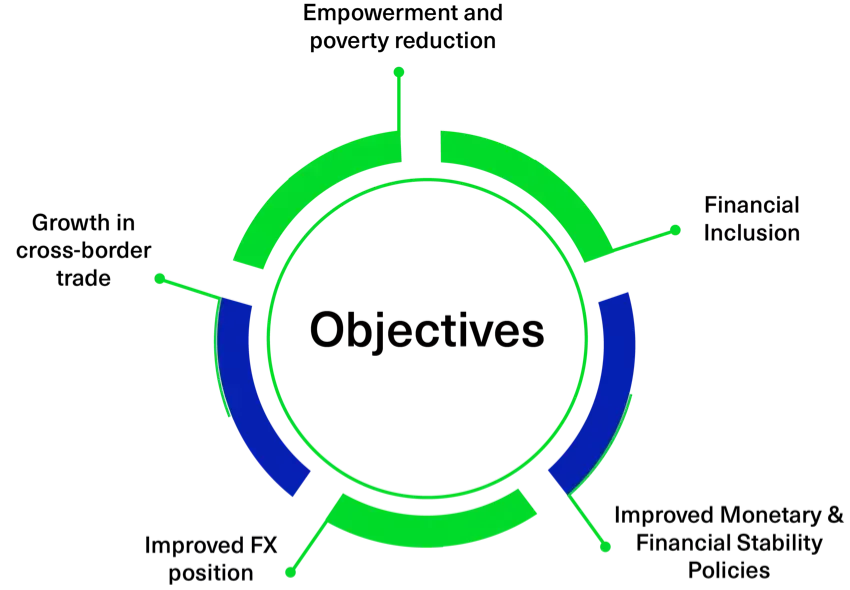

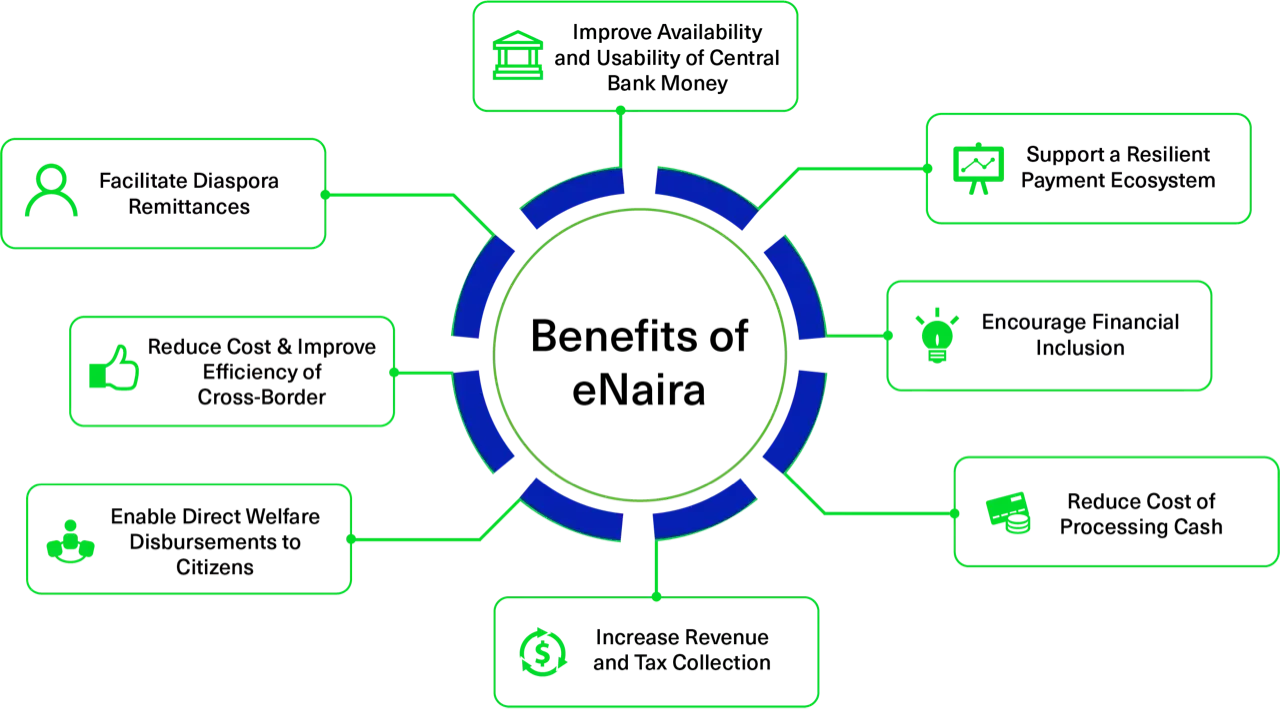

Objectives of eNaira

In driving this core objective, the eNaira will also deliver on key economic objectives of the CBN highlighted below whih will impact overall economic growth and that generate significant social and economic benefits for all Nigerians.

Developing and

Deploying the eNaira

The CBN wanted the eNaira’s usability to be on par with advanced payment applications already in Nigeria. Value was to be the differentiator. Bitt worked directly with CBN to determine the ideal technology solutions to meet the functional, ethical, and monetary policy requirements for Nigeria’s use cases, scope, and other factors.

- CBN went through our product’s functionality, hosted in a sandbox environment, identified the key requirements that would be required for the initial launch, and started building a list of items to include in a roadmap.

- We defined the main configurable aspects of the solution, such as branding, wallet tiers, transaction alerting, onboarding flows for consumers and merchants.

- We implemented and configured the solution in CBN’s hosting environment.

- We worked with stakeholders, such as banks and the national payment system, to integrate the solution.

- We supported the CBN and stakeholders to mint their first eNaira, set-up banks and merchants.

- We conducted extensive testing, including a closed pilot with real users and stakeholders, prior to the launch event.

2021 - 2024 Milestones

Press Releases

- Bitt Develops Africa’s First CBDC Oct 25, 2021 Read Article

- Bitt Awarded CBDC Contract for Central Bank of Nigeria Aug 30, 2021 Read Article