FTX Lessons For Stablecoins & CBDCs

The negative fallout from the FTX debacle is adding momentum to the adoption of central bank digital currencies (CBDCs), while positively demonstrating the resilience of blockchains and decentralized finance (DeFi).

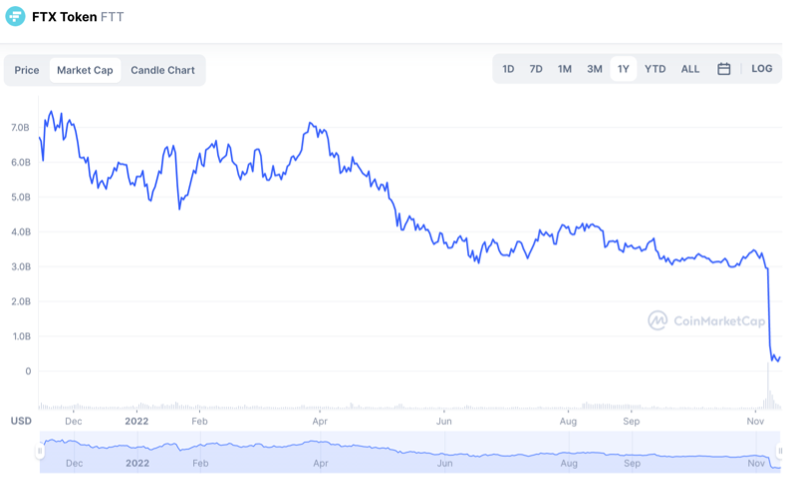

Samuel Bankman-Fried’s (SBF) FTX was supposedly an exchange — acting as the custodian of customer’s funds — while, apparently, loaning $10 billion of their customers’ dollars to Alameda Research, a hedge fund also owned by SBF. Meanwhile, Alameda was posting FTX’s own token, FFT, as collateral for these loans. One year ago, an FFT was worth $56, with a market cap of $6.7 billion. Today, an FFT is worth $1.26, with a market cap of $278 million.[1]

This is the second major token meltdown in six months, draining billions from cryptocurrency markets and threatening wider contagion into the financial system.

"A lot of people have compared this to Lehman. I would compare it to Enron,” said former Treasury Secretary Larry Summers, who listed the reasons for his comparison. "The smartest guys in the room. Not just financial error but, certainly from the reports, whiffs of fraud. Stadium namings very early in a company’s history. Vast explosion of wealth that nobody quite understands where it comes from."[2]

Unlike FTX, blockchains and smart contracts in decentralized finance (DeFi) markets didn’t blow up; in fact, they worked just fine, despite enormous volumes. What failed was risk management in FTX’s centralized exchange, compounded by related party self-dealing with Alameda and, quite likely, flawed accounting and fraudulent disclosure.

The redemption tsunami reverberated through the market of private stablecoins. For example, on November 10, Tether’s USDT token slipped off its 1:1 dollar peg and traded as low as .96, according to Bloomberg.[3] After the Terra USD meltdown in May, it went even lower to .945.

Monetary authorities are scrambling to deal with the meltdown risk of “private money” offered by unregulated entities. The Bank for International Settlements (BIS) makes the case that some stablecoins are fatally flawed and that CBDCs are the best solution.

“The prevalence of stablecoins, which attempt to peg their value to the US dollar or other conventional currencies, indicates the pervasive need in the crypto sector to piggyback on the credibility provided by the unit of account issued by the central bank”, said the BIS. “The fact that stablecoins must import the credibility of central bank money is highly revealing of crypto’s structural shortcomings.”

After the Terra meltdown, but before FTX’s, the BIS called out the “moral hazard” posed by the business model of private stablecoin issuers in its Annual Report. “There is an inherent conflict of interest in stablecoins, with an incentive for issuers to invest in riskier assets….The robustness of stablecoin stabilisation mechanisms depends crucially on the quality and transparency of their reserve assets, which are often woefully lacking. They must import their credibility from sovereign fiat currencies, but they benefit neither from the regulatory requirements and protections of bank deposits and e-money, nor from the central bank as a lender of last resort.”

Going forward, the BIS further argues that since private stablecoins are free-riding on the central bank’s role as issuer of sovereign fiat currency and lender of last resort, while profiting from moral hazard, the best solution is for the central bank to issue a national fiat stablecoin – a CBDC – itself. Only a solid, stable CBDC can serve as the foundation for the “future monetary system”, as decentralized finance (DeFi) techniques transform asset markets. It’s a big deal, when the usually muted and indirect BIS makes a strong policy recommendation like this.

“New private applications will be able to run not on stablecoins, but on superior technological representations of M0 – such as wholesale and retail CBDCs…CBDCs that are transacted using permissioned distributed ledger technology (DLT) offer programmability and atomic settlement, so that transactions are executed automatically when set conditions are met…The data architecture underlying both retail fast payment systems (FPS) and CBDCs can give much greater user control over personal data, while preserving privacy and consumer welfare.”

Last month, the International Monetary Fund (IMF) piled on, agreeing with the BIS, and arguing that, “Where currently unregulated/under-regulated entities will be allowed to perform functions in the stablecoin ecosystem, authorities must develop bespoke regulation or revise existing regulating frameworks to ensure that all entities that perform these functions are licensed or authorized”, adhering to the principle of “same risk, same activity, same regulation.”[4]

Bitt provides a secure, blockchain-based digital currency platform that is used by central banks to issue fiat currency CBDCs, and by regulated financial institutions to issue their own stablecoins. The data sets generated by our platform provide monetary authorities with deep insight into the stability and liquidity of the financial system. Please see our previous Bitt blog on “Getting Prudential Regulation Right With CBDCs.”

Our platform was designed to remove all personal identifiable information (PII) from the CBDC and stablecoin transactions before posting them to the blockchain, thereby preserving user privacy, as the BIS recommends. In sum, Bitt’s platform enables monetary authorities to ride the wave of digital transformation in financial markets while prudently observing the principles of “same risk, same activity, same regulation.”

[1] https://coinmarketcap.com/currencies/ftx-token/

[2] https://www.foxbusiness.com/markets/larry-summers-ftx-could-be-enron

[3] https://www.bloomberg.com/news/articles/2022-11-10/tether-usdt-dips-below-1-as-ftx-fallout-continues-to-roil-markets

[4] “Regulating the Crypto Ecosystem: The Case of Stablecoins and Arrangements, “ IMF Fintech Note/2022/008, page 8.