The First Steps to Building a Digital Economy – Why Digitizing The Barbadian Dollar Matters.

On February 26th, 2016, Bitt launched a digital version of the Barbados dollar – a collection of 0s and 1s was now worth a ‘Barrow’. It was the world’s first ‘blockchain-based digital money’; the first time that this revolutionary new technology had been applied to making already-existing currency digital.

That’s industry speak for something very simple. We took the Barbados dollar, made it digital, and accessible from any smartphone. In that moment we began a process that will eventually axe a whole host of economic and personal financial problems that have plagued the Caribbean for decades.

Our vision is simple: build a financial system that allows everyone to pay for goods (in-store or online); send and receive money from any point on the planet for a fraction of the cost; and do a whole host of other daily penances from the comfort of their couch – like pay bills or check their spending. Anyone, anywhere, any smartphone.

The first step towards all of this was our world-first: digitizing the Barbados dollar.

Cash 2.0, Society 2.0

In 2007 Vodafone launched M-Pesa in Kenya. It was an immediate revolution in microfinance (a tool that’s designed specifically for lower-income persons and developing economies). It took the point of parity between lesser developed economies and the ‘first world’ – mobile phone penetration – and it gave the world an entire new way of thinking about money.

Banks are expensive to build and staff. ATMs are only installed if they can recoup their investment. The infrastructure of the financial world is brick and mortar and human bodies sitting behind mahogany desks.

The United States has 200 ATMs for every 100,000 people. Jamaica has 30 ATMs for every 100,000 people. The disparity is glaring. However, of a population of 2.93 million, around 2.8 million Jamaicans own a mobile phone and are connected to a mobile network. Haiti has a record low 3 commercial bank branches for every 100,000 citizens but boasts a 73% mobile penetration rate.

We are living through a transitional period, where the technology that facilitates global communication can also change the way we interact with money. That futuristic image of someone tapping two devices together to pay for something? Near-field-communication technology, it’s how Apple Pay works.”The cell phone is the best point-of-sale terminal ever,” says Mark Pickens, a microfinance analyst with the Consultative Group to Assist the Poor – not only because the technology is advanced (we have more computing power in our back pockets than sent rockets to the moon), but it’s available to everyone.

This isn’t just about digital for the sake of digital – new for the sake of new. These kinds of systems are built around users; they’re a replacement for physical cash transactions, which are generally smaller. Banks and larger entities aren’t designed for these kinds of transactions. Credit and debit cards have limits, uses, fine print and a list of requirements. Bank fees cut into low income accounts and hemorrhage what little money people are able to hold onto. Digital cash solutions like Bitt are able to privilege micro-transactions, make them affordable for the first time.

Technology has allowed us to regain control over many areas of our life. The world’s changing. We rent out our sofas and spare rooms to strangers over the internet; rely on our smartphones to guide us in cities we’ve never been to; listen to music in languages we barely understand and consume media from halfway around the planet. These were all impossibles just thirty years ago.

Our lives look nothing like our grandparents’ – why do we still use their money?

Our money should be as modern as we are. It should be as open and barrier-free as the rest of our lives. Part of the mobile money revolution is peer-to-peer transactions. The technology allows two people to send money without the need for a chain of companies (and a chain of fees). It allows mother’s in Jamaica to connect with their sons in the Bronx; daughters in Toronto to send money back to Barbados. It let’s entrepreneurs start businesses and turn their phones into a point of sale system. It let’s already established businesses expand online with the Caribbean’s first digital payment solution.

It’s a new kind of financial highway, and because it uses the best that technology has to offer – it can support and run off of zero transaction fees. No fees for any user, at any time.

We’re pioneering a new kind of financial system, one built for Caribbean people – not built for some completely alien community and transplanted here.

Working for Trust

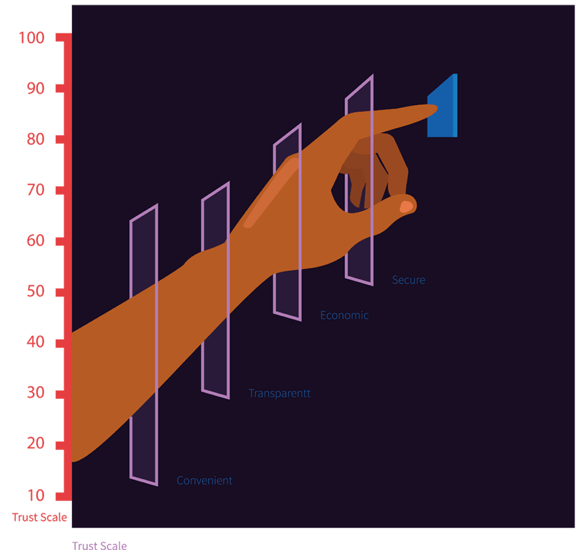

One of the biggest barriers to digital money, or any kind of new financial system like this, is trust. We talked in our last blog post about how harmful cash is (for our health and for our economies), but we’ll still use it. We use it because we trust it. We use it because other people trust it.

We don’t trust easily with our money – we worked hard for it, we see in it all of the things that we want to own, accomplish or change in the world. Money is an access point that facilitates happiness.

That’s why Bitt is doing everything in our power to work alongside regulators, Central Banks of the region, industry experts and specialists in every field from security to compliance.

We’re bringing new technology, but we’re building that technology for trust.

Our mission, our transparency and our drive have won us the support and friendship of incredible people. Overstock.com CEO Dr. Patrick M. Byrne, on the eve of their historic investment in Bitt, said that ‘We (Overstock.com) respect and endorse that vision, and share a common desire to see online consensual exchange flourish globally.’

We’re bringing the best that exists on this planet and transmuting it into something that we can be proud of. It began on February 26th when we pushed down global barriers – doing something that other ‘more developed’, ‘more advanced’ countries couldn’t. It won’t stop there.

Our CFO and President, Oliver Gale is passionate about change. “Gresham’s law is simple – good money drives bad money out of circulation. We are promoting cryptography, technology and bringing all that is new and people-focused to money systems. Our job as innovators is to define the future, not accept what was given to us.”

Bitt is built on the trust and support of every Barbadian. In return we pledge transparency, idea sharing and information.

Our mandate is ‘Empower people’. This is an incredible nation, let’s be world first’s and create a financial system that empowers all of us. Financial systems that are made by us and make sense for us.