Payment Innovation and the Barbadian Digital Economy

In the Caribbean we’re comfortable with the payment technology we currently use, only because we have no alternative. We’ve memorized PIN numbers and are comfortable swiping credit/debit cards. But this is the extent of payment technology development in the region – we’ve launched as far forward as 1980s technology, and here we are marooned.

What does Payment innovation look like? And why have we been so limited?

There are a lot of complicated intermediaries at play behind the scenes. A credit card requires the weigh in of multiple entities – from Visa, to an acquiring bank, to an issuing bank, to a clearing house. While these transactions feel ‘instant’ for the person swiping – they’re anything but. It takes hours, or sometimes days, for transactions to finally be settled (for the money to move between banks and accounts). It’s not as cut and dry as swiping and walking away.

There are two sides to the payment innovation problem – paying, and being paid.

Let’s talk about paying first

The first thing to remember is that people don’t like to spend money. There’s a behavioral economics term called ‘the pain of paying’. It’s that feeling of annoyance/regret and a slight tinge of bitterness whenever you have to hand over money. Whether its cash or plastic, we feel it. We experience pain of paying, because we are loss averse – we’d rather receive than give away.

On the consumer side we don’t want to have to think about payment. We want things to be instant, cheap, easy and ignorable. In a lecture to the Belgian Financial Forum, Yves Mersch summarized it brilliantly, ‘it is incomprehensible why e-payments should take longer than e-mails’. In a world where everything is instant, waiting the 10-30 seconds for a debit card confirmation is a lifetime.

That’s why new technology like near-field-communication or one-tap

payment are taking off so dramatically. The ability to tap devices

together to confirm payment, or pay from a cellphone, they all reduce

the time we spend engaging with payment. They reduce the pain factor.

Paying is always easier than being paid.

In 2013 Damien Forsythe (Manager of e-commerce at the MWF Group, Bahamas) lamented that the e-commerce sector continued to be challenged as commercial banks did not facilitate local businesses to receive online payments. A structure exists, despite being outdated and costly, to allow in-country payments through credit/debit cards – but it remains exceedingly difficult to receive international payments.

The internet has no boundaries or borders. It knows no countries or regions. Sites like Etsy and Ebay prove that there is a global market for just about anything – no matter the niche size. The problem is how do you, as a Barbadian citizen, engage with the outside world? We can set up an e-store, parade around our wares, but being paid is the challenge.

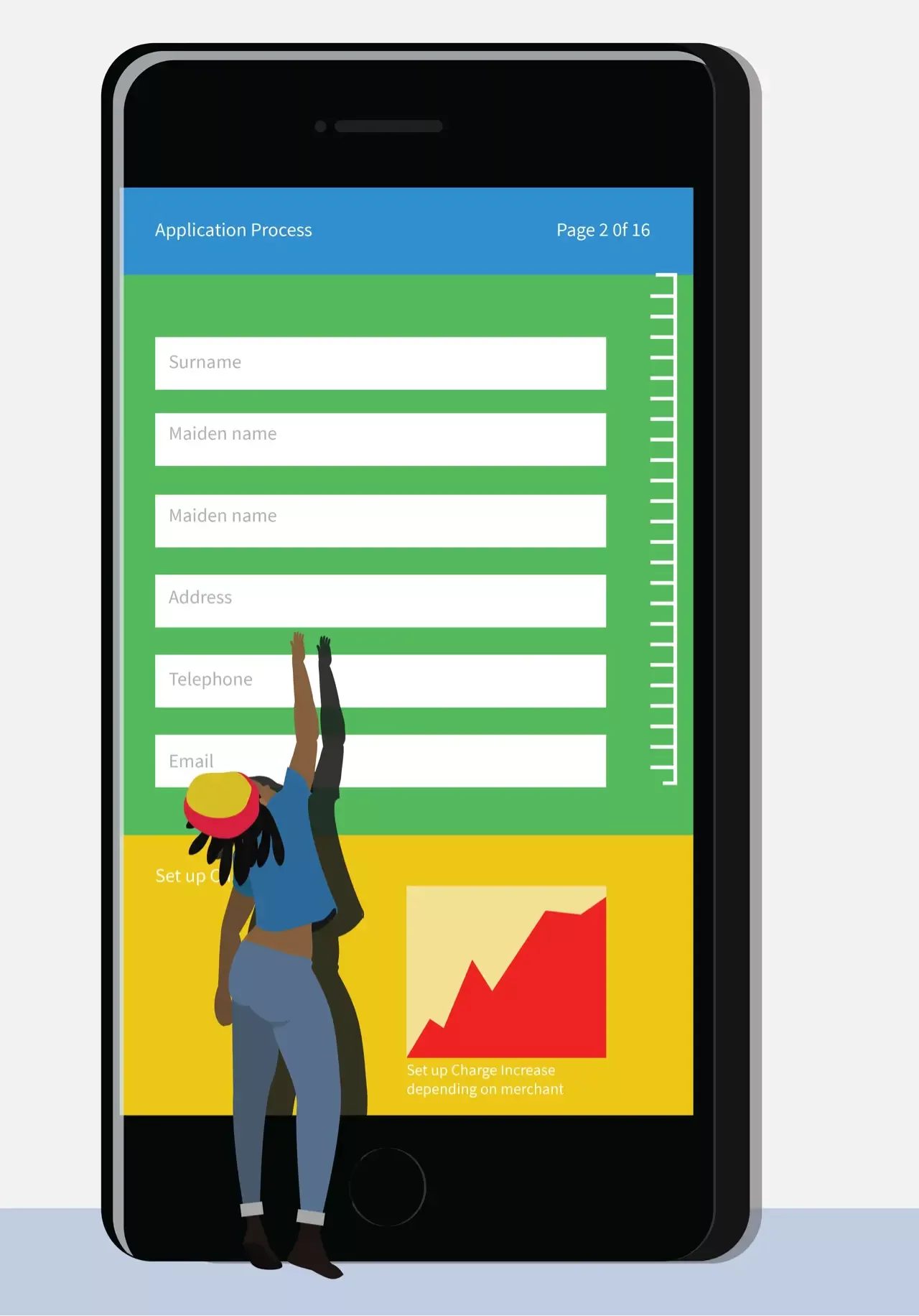

The currently available route requires an ‘especially rigorous’ application process that not many companies, far less sole proprietors can navigate. It also requires a lot of on hand capital to deal with expensive set-up charges and navigate the fees that large incumbent institutions can charge. There are Barbadians at this precise moment trying to take part in the global rebirth of small-scale enterprise (from putting a room up for rent on Airbnb, to trying to ship their art overseas). Many of them are turning to archaic instruments to receive payment (like wire transfers – which can take up to a fortnight to clear).

It’s difficult to think of Barbados as an economic climate that can produce an Uber, or an Airbnb – companies that can connect massive amounts of people and create new types of enterprise. Not because we lack the talent, skillsets or determination – but because we lack the payment infrastructure for a company like that to survive onboarding millions of users.

The Caribbean has some of the most brilliant minds – it’s an injustice that the true gift of internet access (being able to create a business

that ignores borders and foot traffic) is denied us.

The Blockchain Solution:

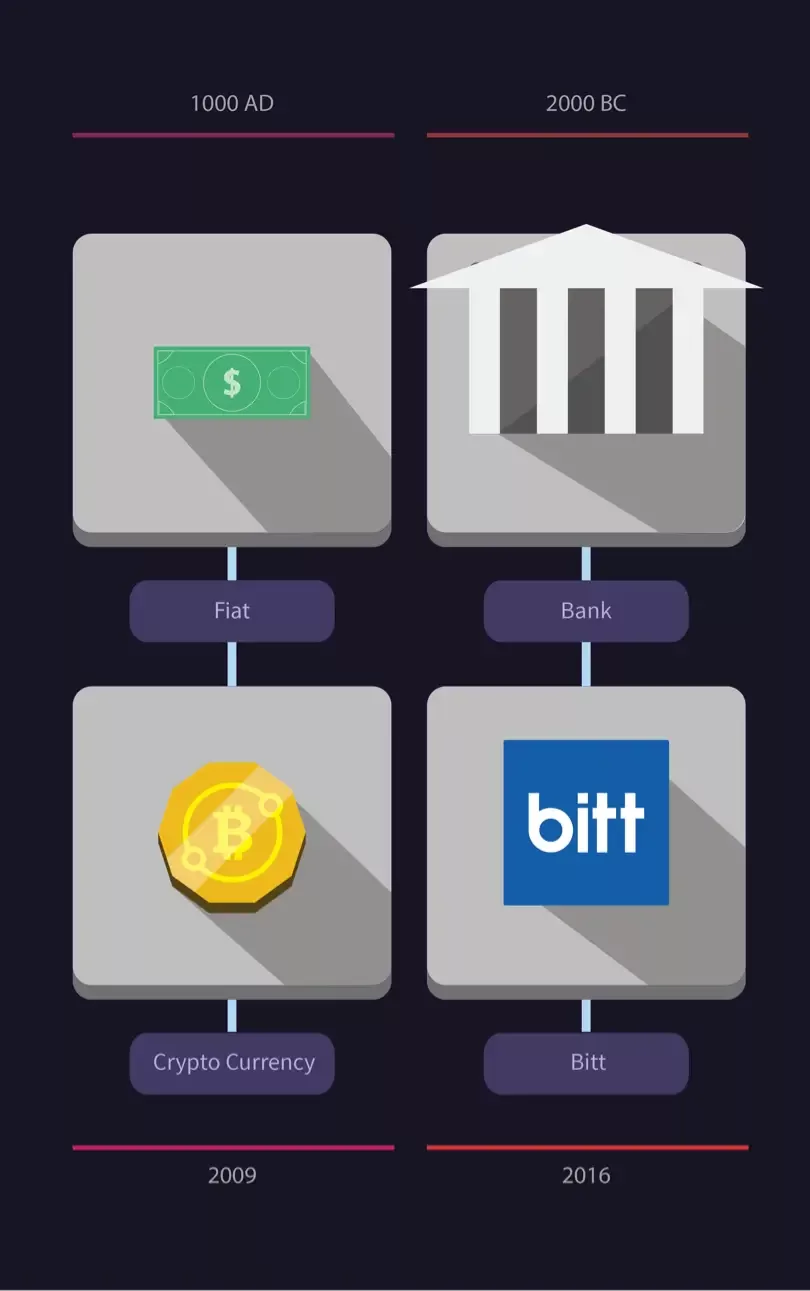

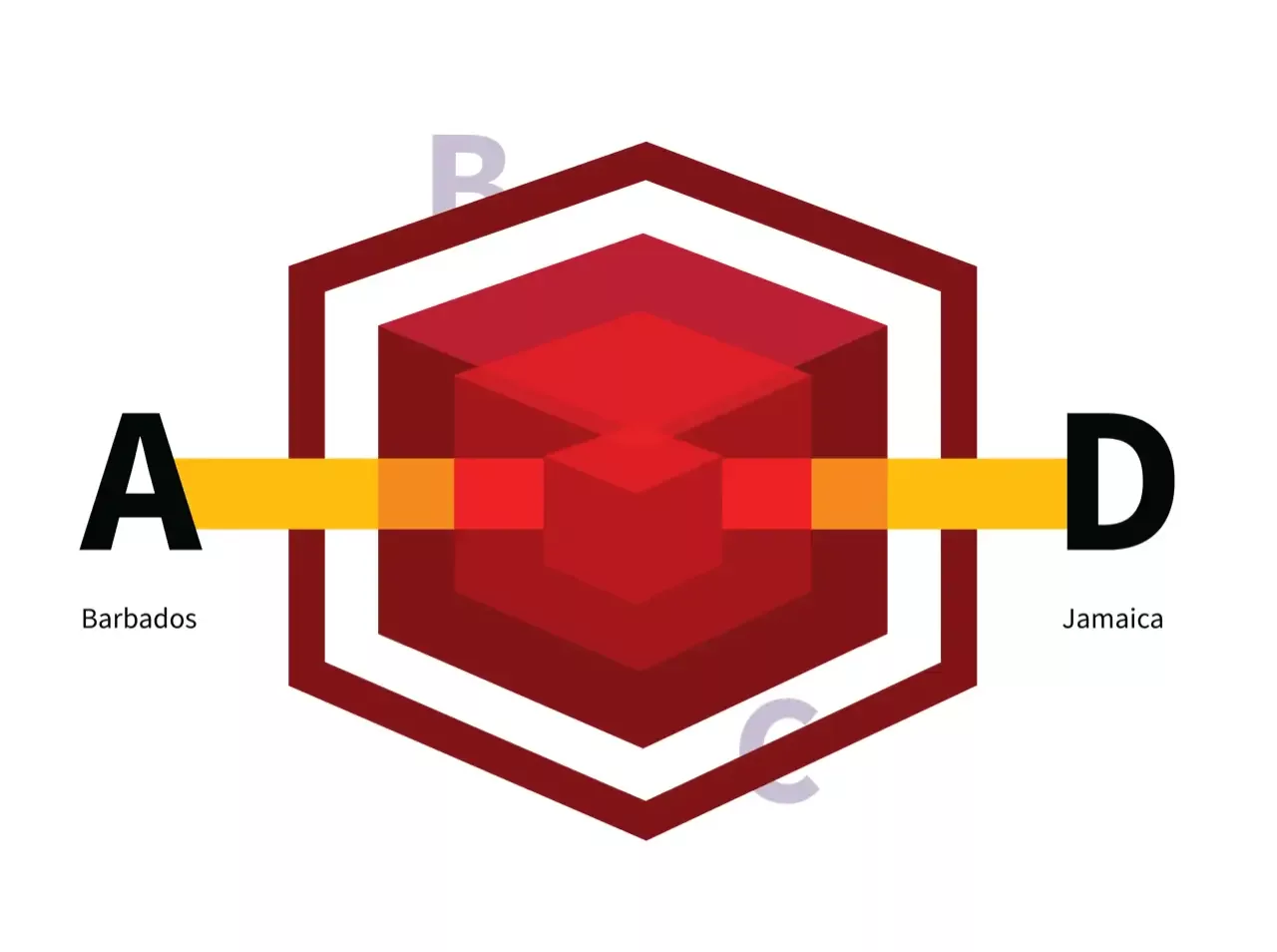

Part of the mess of the current financial system is its outdated communication tools. Banks utilise internal databases that then have to connect to other banks through complicated correspondent channels. Person A can’t just talk to person D they have to include persons B and C(even if they’re not a part of the conversation).

Think of the Blockchain as a priority phone line. It can put two entities in contact as easily as two people can be connected over a

mobile network. When we do away with complicated channels, we allow for flexibility. Bitt utilises this technology to tackle both ends of the

payment problem, innovating for paying, and being paid.

We’re in the process of building an online solution so that any business, no matter the size, can receive international payments and finally engage with their community. Or build one from scratch. We’re also preparing to launch an updated version of our wallet with new features that cut down on the pain of paying.

We’re innovating for a Caribbean that wewant to see take shape – one where the barriers to commerce are lower and the focus can finally return to the creative spirit of the entrepreneur.